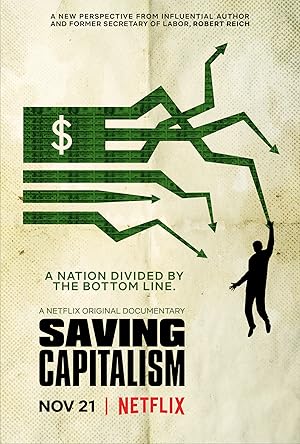

Saving Capitalism Page #4

- Year:

- 2017

- 90 min

- 2,392 Views

to build data centers.

And the United States

Department of Agriculture

spends $20 billion every year

on subsidies that go mostly

to the largest producers.

These subsidies are costing taxpayers

tens of billions of dollars every year.

Some estimates put it at over 100 billion.

That's more than the cost to fund

the entire Department of Education.

We have a huge system now

aid for dependent corporations,

subsidies and tax breaks that have

no economic justification at all,

that are there

because individual corporations

or specific industries

have lobbied to get them.

It's in the tax code.

It's in appropriation bills.

It's in our trade laws.

Wherever you look,

you find corporate welfare.

I began to feel, in myself, some anger...

towards people I knew

in the administration

with a lot of power.

Not anger at them, personally,

because they were nice people.

I enjoyed them.

But anger at not only

what they represented,

but the narrowness of their view.

It was as if Washington was an island

that was separate

from the rest of the country.

The voices of average citizens

had disappeared -

all but disappeared.

Another member of the

Clinton administration announced today

that he's dropping out

of the game entirely.

Labor Secretary Robert Reich,

who's been a central player

on the President's domestic policy team,

is returning to Massachusetts

to spend more time with his family.

My friends, we are on the way

to becoming a two-tiered society...

composed of a few winners...

and a larger group of Americans

left behind,

whose anger and whose disillusionment

is easily manipulated.

Once unbottled,

mass resentment

can poison the very fabric of society,

the moral integrity of a society,

replacing ambition with envy,

replacing tolerance with hate.

Today, the targets of that rage

are immigrants,

and welfare mothers,

and government officials,

and gays,

and an ill-defined counterculture.

But as the middle class

continues to erode,

who will be the targets tomorrow?

You can see the cumulative effect

of all of this over time.

Wealth creating political power,

creating changes in the rules

that enhance wealth.

It's not sustainable.

It's getting worse and worse and worse.

Big trouble for millions

of American homeowners,

as foreclosures across the country

are up a staggering 87%.

The number of Americans

either behind on their mortgage payments

or in foreclosure

rose to record levels

in the third quarter.

Those mortgages made to borrowers

with poor credit histories

are called sub-prime loans.

And the explosive growth in this kind of

lending in the past few years

is now having a devastating impact.

We are briefly interrupting

regular programming

with the latest on a wild day today

on Wall Street

officially crashed.

Now, three of the top five

Wall Street institutions are gone,

leaving many to wonder

whether Americans can trust the system

So, what happened in the 2000s?

Well, Wall Street went amok.

I mean, completely crazy.

They're gambling with people's deposits.

They're...

They're gambling with the entire economy.

These are not aberrations.

This is not an accident.

Since the Reagan administration,

there's been a systematic changing

of the rules of our financial system -

always billed as deregulation

that would get government

out of our free market.

Government, with its high taxes,

excessive spending,

and over-regulation,

has thrown a wrench in the works

of our free markets.

Then in 1998,

Wall Street devised

new complex financial instruments

to maximize their profits,

known as "derivatives".

Despite warnings, these went unregulated.

What are you trying to protect?

We're trying to protect

the money of the American public,

which is at risk in these markets.

And then, in 1999,

Clinton did away

with the Glass-Steagall Act.

We're here today to repeal Glass-Steagall

because we've learned

that government is not the answer.

We have learned that freedom

and competition are the answers.

The Glass-Steagall Act

was a 1930s law

designed to protect people's savings

from being used by

Wall Street speculators.

But now, with no laws in place

to keep risky investment banks

from merging with commercial banks,

or controlled derivatives,

we ushered in too-big-to-fail mega banks,

that led to the stock market crash.

There's this fiction that

somehow you have

regulation or deregulation.

You don't have regulation

or deregulation.

The question is,

what regulation do you have?

You allowed commercial and investment

banks to get together

and then what happened

is you have a new kind of regulation.

It's called "bailouts".

Good evening and even congratulations.

You are now the proud owner

of a massive insurance company.

American taxpayers woke up this morning

most of a bailout package

the Federal Reserve slammed together

to save a huge insurance conglomerate

called "AIG".

The rescue of Bear Stearns, Fannie Mae,

Freddie Mac and AIG

puts an extra $314 billion

The administration and

Congress are hammering out the details

for what would be the largest

financial bailout in US history.

This is a big package,

because it was a big problem.

We're not getting rid of government.

That's the point.

Government will still be involved.

The question is,

how is government going to be involved?

Is government going to be involved

relatively small and tame,

or is government going to be involved

in dealing with the consequences,

from homeowners and everybody else

sweeping up the mess?

In other words,

it's not government versus no government.

It's...

what are the government rules going to be?

I received my diagnosis

in January of this year.

After receiving an infection abroad,

I came home and was treated for that.

And while in the hospital,

they discovered that I had cancer.

I have a couple of different medications

for nausea.

There are two specific ones that I take

on days two and three after chemo.

I get a steroid when I'm in the hospital

to get me through the treatment,

an antibiotic,

and another that helps me sleep,

because I get kind of a weird vertigo

during a certain point

of my treatment cycle.

Even with the insurance provider

that I have,

I was informed that they no longer cover

chemo drugs fully.

And so we were told

by a medical social worker

that we could potentially

receive a bill for thousands of dollars.

With the four drugs

that I take for chemotherapy,

the total comes out

to about $3,000 a month,

per treatment.

So, for me,

that's about three months of income...

just for...

Just for one round of treatment.

What is the alternative to receiving

your chemotherapy drugs?

There isn't one.

So whatever the cost is,

you have to pay it.

You and I

and everybody else in this country,

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Saving Capitalism" Scripts.com. STANDS4 LLC, 2025. Web. 23 Feb. 2025. <https://www.scripts.com/script/saving_capitalism_17516>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In