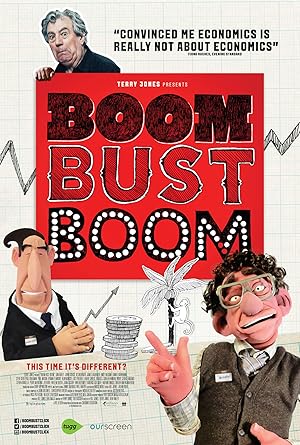

Boom Bust Boom

This film is about

the Achilles heel

of capitalism, how human nature drives the economy

to crisis after crisis time and time again. Every generation

thinks it's smarter than its

parents and its grandparents, and it never proves

to be the case. What happens is a crisis

fades into memory and then it becomes history. That is the reason we often give for why we study history

and why we teach history is to not have to repeat

the mistakes of the past. You ever seen the State of

president comes on and says, "Guys, we're f***ed." These booms and busts

will always be with us. It's in human nature

that they would be with us. And I've said before,

Mr. Deputy Speaker, "No return to boom and bust." ( all cheering ) ( footsteps ) The human strategies

we're seeing in real markets are just

evolutionarily

really old. They're kind of leftover

the strategies from

35 million years ago. WILLEM H. BUITER:

It is very hard to, eh, understand why economists focus on models

in which crises

could not occur. They run the economy

based on science fiction models. That's why they had no

idea this crisis was coming because they ignored

banks, debt, and money. ( clattering hooves ) GEORGE MAGNUS:

We always thought

how lucky we were that we never actually

had to live through

in the 1929 crash and the 1930s

Great Depression, because

we are cleverer now and we know how to avoid

these kinds of accidents, and actually,

a lot of economists were absolutely adamant that

the worst would not happen because we know how

to deal with these things. And, of course,

the truth is, we didn't know

how to deal with them. TERRY JONES: In 1928,

President Calvin Coolidge gave his State

of the Union address in the following terms: In the domestic field, there is tranquility and contentment... and the highest record of years of prosperity, the great wealth created by

our enterprises and industry, and saved by our economy, has had the widest

distribution among

our own people. The country can

regard the present with satisfaction and anticipate the future with optimism. ( all applaud ) ( singing ) TERRY JONES: He didn't

know what we know now, that the United States

was about to suffer the worst economic

disaster in its then history. Our economy's healthy

and vigorous, and growing faster than other

major industrialized nations. The American people

have turned in an

economic performance that is the envy of the world. TERRY JONES: He didn't know

what we know now, that the worst crisis ever

to hit the Western economies was just around the corner. The crisis of 2008 is often referred to

as the subprime crash. In less than 15 years,

there was a huge rise in lending mortgages to people who basically

couldn't afford them. Ladies and gentlemen,

Harvey Rosen, Chairman of

the White House Council

of economic advisers speaking in 2007. The main that innovations

in the mortgage market have done over the

past 30 years is to let in the excluded,

the young, the discriminated against, the people without

a lot of money in the bank to use for a down payment. ( muttering agreement

and affirmation ) JONES: This reckless

lending to people who

couldn't afford a mortgage became known as

subprime lending, but the banks insisted they had eliminated risks

by statistical processing. When you look at how

banks managed risks, particularly before the crisis-- this is very interesting,

and quite funny actually. What they did was

to take risky assets, such as, um,

junk mortgages, slice them into little bits, repackage them

after mixing them

with all the risky bits, and then sell them

on to other banks

and financial institutions. And so these risks became uh, dispersed in

the financial markets, and nobody really knew

anymore where the risks were or for that matter,

nobody knew exactly

whether the... package of

financial products

that he was buying, that he was

investing in, was risky, whether it was very risky

or not risky at all. JONES: They sold these

packages to investors as very low-risk products. Banking organizations of

all sizes have made substantial strides over

the past two decades in their ability to

measure and manage risks. So, because we could not

observe risks anymore, we were telling ourselves,

"There is no risk." What's even worse

when you do this, risks become

connected with each other. You don't know exactly

how the risks are connected, but they are. In the pre-crisis period, we told ourselves a story about the bigger banks being able to spread their risk

across their balance sheet, which would then allow us as regulators to enable them to run

with lower safety margins. Everybody was

happy and confident that the mortgage market

had become more

efficient than ever. And I have said before,

Mr. Deputy Speaker, no return to boom and bust. Our economy is healthy

and vigorous, and growing faster than other

major industrialized nations. Everyone was convinced that this time,

it's different. ZVI BODIE:

The subprime crisis of 2008 was essentially

a bubble bursting. They lent lots of

money against houses. I've seen them in Gary, Indiana,

in Detroit, Michigan, that you can now buy

for ten grand. But they'd lent u-usually

about a hundred grand, so that poor people who'd

never, ever owned a house

before could own a house. When we take your

income and your wealth, you measure 620

on the FICO scale. 620? that's great. No, no, no, no, no.

You see, we financial wizards reckon 850 on

the FICO scale is good. And 300 is very, very bad. You see, most people score

about 725 on the FICO scale, and I'm afraid 620

is usually our cut-off point. Oh, dear, so, I won't get

my interest on the mortgage ( laughing )

Not so fast. You could still be eligible

for a stated-income

verified assets loan. What's that? That's where you

state your income and

we verify your wealth. Well, I'm worth

one million dollars. Oh... Can you prove it? Not really. Look, we really

want your money. Uh-uh, I mean, we really

want you to have this

interest-only mortgage. So, we can go down

the stated-income,

stated-assets route. What's that? You state your income

and assets and we

don't check them. Great! Well, eh, then-then that's

all signed and sealed. Believe it or not, this scene

or something like it, must have been played out

numberless times. In 2004 to 2005, more than a third

of all mortgages were no income,

no jobs or assets, that were nicknamed

"Ninja Loan." Hiyah! Hiyah! That's what this was about. It was about forcing loans onto people who

would never repay them, who would end up

getting foreclosed, in order to earn a fee

on the origination and another fee when they

were sold to some sucker

who would take the loss. The whole thing

becomes, eventually,

a bit of a con trick because, everybody thought

that asset prices would

continue to go up. The unimaginable happened. Housing prices

started to fall. That signaled to them that

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 21 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In