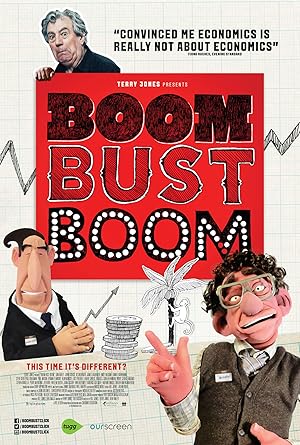

Boom Bust Boom Page #2

they could never pay that debt, because they were relying

on the house price to rise as we all do in these bubbles. And then, um, like a,

string of dominoes, the very risky lenders knocked over

the risky lenders, knocked over

the normal lenders, and then they

all fell apart. Ain't got no home Ain't got no shoes Ain't got no money Ain't got no class Ain't got no skirts Ain't got no sweater Ain't got no perfume Ain't got no bed Ain't got no man JONES: The banks were

taking on more and more risk, Investing in the

financial economy instead of the real economy. The financial economy,

as it's become, is essentially making

money out of money, instead of investing

in firms and companies and contributing to

the real economy. So what happened to the banks

and the insurance companies that got involved in

the subprime lending? You can think of the-the

the end of 2007. What happened? The bank starts looking

a little more carefully

at their balance sheet. They look at the assets

they got and they say, "Wow, a lot of those

assets are trash. "Okay, we know that

these things are bad, "a high percentage of them, "and, um, some of our assets "are the I-O-U's

of other banks. I wonder if their balance

sheets are as bad as ours." And they started to think, "They probably are

because we're all doing

the same stuff." And then they say, " You know,

maybe when that loan comes due, "we should call it in, "say we're not going

to renew it anymore, "because we think, maybe, you could get in trouble

and we wont get paid." Suddenly, all the banks

started doing this. And, basically, that is when the global

credit markets froze up. Banks wouldn't lend

each other anymore. And so that turned into

a massive liquidity crisis, and that is what

set off the whole thing. So this layering

of debt on debt, financial institutions owing

other financial institutions, turns out to be

extremely dangerous. News you're waking up to: the American investment bank

Lehman Brothers has filed

for bankruptcy in New York. That's happened in

the last few minutes. It means the Wall Street

institution, which has been

in business for 150 years and survived

the Great Depression, is now the most high-profile

casualty of the credit crunch. JONES: It was not only

Lehman Brothers that went bust. In the U.S., Citigroup were

rescued by the U.S government with guarantees to the tune

of 300 billion dollars. AIG were bailed out for

a 182 billion dollars. The best things in life

are free But you can give 'em

to the birds and bees Bear Sterns was taken over

by J.P. Morgan after the U.S. government

secured them with a 30 billion dollar

guarantee. Fannie Mae and Freddie Mac, government-backed

mortgage lenders who were involved

in the sub-prime

mortgage lending, were rescued by

the Federal Housing

Finance Agency. Merrill Lynch was taken over

by the Bank of America. In the UK,

the Royal Bank of Scotland was bailed out

by the UK government for 20 billion pounds, HBOS was bailed out

for 13 billion pounds, and Lloyds

for 4 billion pounds, on exactly the same day,

October the 13th, 2008. Money don't get everything,

it's true But what it don't get,

I can't use Sir, another insurance company

is going under. Now determining most prudent

move for insurance company. ( chicken crowing ) Bailout! The most prudent move

is a bailout! I remember sitting, um...

uh, in a room. Bit like this one,

at the Treasury, back in 2008, around the time

of the Lehman crisis. We sat there. During the first half hour

of that meeting, the share price of one of the biggest banks

in this country fell by 50 percent. In the 2nd half hour

of that meeting, the share price

of that same bank rose 50 percent. We knew at that point,

this wasn't Kansas anymore. I mean, if the 2008 crash

didn't wake people up, um, I don't know what will. ( yawns ) Where do we go from here? How do we deal

with these financial crisis? And one of the

most important first steps is understanding

where we've come from. Financial crises aren't some new thing

that we're going into now. We've had many financial crises. The 19th century is filled

with financial crises, and even the 18th and 17th

and 16th century, and when you start looking

at all these different examples of economies

and their financial systems

and their crashes, you start to get

a much better understanding of what financial crisis

is about. The seeds that were sown were the same seeds

that were sown in all previous crises. So, if we look to what works

and what doesn't, no better lessons are there

than those from history. Tulip Mania started back

in 1562, when a ship from Constantinople

docked in Antwerp. Aboard was a cargo of tulips, the first to be seen in Europe. Oh, tulips,

precious tulips I kiss you

with my two lips Make me healthy,

make me wealthy Tulips precious tulips The tulips proved

to be a sensation amongst the rich merchants

of Amsterdam, then embarking

on their golden era. The merchants

built grand houses surrounded by flower gardens, and the star of the show

was the tulip. Tulips grew in prestige

and popularity, and prices began to soar. By 1636, a tulip bulb

could be worth a new carriage,

two grey horses, and a complete harness. Some bulbs were reportedly

changing hands over ten times a day. It seemed like everyone

could make money if only they bought tulips. A kind of euphoria

gripped everybody. But, on February the 5th, 1637, it all came to an end. At a tulip auction in Haarlem,

in the Netherlands, only the sellers of tulip

turned up. There were no buyers. Harlem was at that time

in the grip of Bubonic plague, so perhaps that's why

no one wanted to go out

and buy tulips. But the damage was done. The bottom fell out

of the tulip market. Bulbs that had

commanded the price

of 5,000 guilders sold for fifty. This is what economists

call a bubble. Well, a bubble is

a financial episode in which the price of assets, whether it's tulips,

or equities, or gold, basically becomes

completely detached from any intrinsic value. Being in a bubble,

is like... yeah, it's a state

of extreme hope and

excitement and stupidity. And it can continue

for as long as people believe that there is something

magical or new about the valuation today. In every boom-and-bust cycle, there is a period

of exceptionalism. "This time, it's different. Everything is different." And, there's always

a cool excuse, and things like, "Well,

you know, our demographics

are different." Or, you know, "This time,

interest costs really

are very low." Or "inflation

has been solved." Or, "Oh, there's a boom

in gold mining." You know, tulips--

tulips were the first ones. "This is the first time

you'll ever be able

to buy these tulips. You must get in now." There's always a reason

why you'd want to suspend your rational

faculties and buy into this. Normally, it's because

you look around, and you see

everybody else doing it. In 1711,

the British government was deep in debt,

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 22 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In