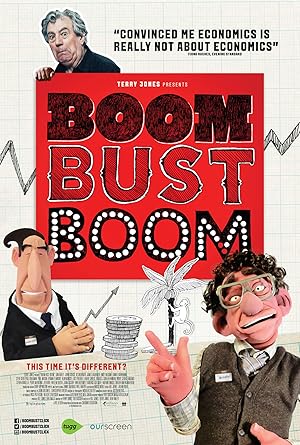

Boom Bust Boom Page #3

to the tune of 9 million pounds. A couple of entrepreneurs named Edward Harley

and John Blunt devised a scheme

to rescue the government. Instead of repayment, anyone to whom

the government owed money was obliged to accept shares in a company called

The South Sea Company. At the same time,

the South Sea Company was given

the exclusive right to the monopoly of trade

with South America. Conveniently overlooked was the fact that Spain, with whom England was at war, controlled all the trade

with South America and had done so

for 200 years. But hopes were high, and the scheme

was a phenomenal success. In 1713, the war ended. Spain then allowed Britain

precisely one ship a year of no more than 500 tons to trade with South America, and one quarter

of the proceeds was to go

to the King of Spain-- not exactly a winning scheme

for a bankrupt country. And, in 1718, the war

with Spain broke out again, and the company's assets

inside South America

were seized, and any prospects

of profit from trade disappeared overnight. But, unbelievably,

hopes were still high. The South Sea Company

talked up the value of its potential trade

with South America, aided by politicians

and members of the government, who were in on the act, and the price of shares rose from 128 pounds in January to 330 pounds in March, 890 pounds in early June, and finally 1000 pounds

in early August. All good bubbles have to burst, and the South Sea bubble burst

in a spectacular fashion. From 1000 pounds in August, the stock fell to a hundred

by the end of the year. With the collapse

of the stock price, thousands of people

were ruined, including Sir Isaac Newton, who lost the equivalent of 2.4 million pounds, and about which,

his niece reported he never liked

to talk about. Newton said, "I calculate

the movement of stars, but not the madness of men." I hope he included

himself in that. The South Sea Bubble

is a perfect example of what is called euphoria. One of the things

we have to control is this tendency for people to go

through these periods, a sort of mass euphoria

and mass pessimism. When people become very

optimistic about the future and they project this optimism into the prices of assets, there can be

an asset bubble. And prices go up,

and when prices go up, people say, "Oh, seems like

people are optimistic

about the future. I should be optimistic too." And so I buy those assets,

and that pushes the price

up a little more. Prices move

completely out of line with any sort of reality or any earnings basis

or, in housing market, any sort of income basis, and it becomes

a self-fulfilling bubble. If you think

you're investing in tulips because you can always sell

the tulips to somebody else at a greater price, you're not investing,

you're speculating. And there is a difference. One is... has a real impact

on the economy, the other is just people handing

money back and forth, and hoping,

that after a while, when the music stops,

they'll be the one who isn't holding the parcel,

who is holding the money. And again, that's okay.

Let them do that. But just don't do it

with your family home

and all your money. When you're in a bubble,

you can't see outside of it, so there's no way of actually knowing

or recognizing it

as it's happening. It looks like success,

it feels like success, which is even more dangerous. Bubbles of the past, you know how they ended. And, when they ended, you understood,

where they had ended. This one hasn't ended yet, so it's completely different

from your memory of the others. It's very hard

to remind yourself of that in the boom times, because everyone else

is making a lot of money, and you naturally wanna make

a lot of money with them. And if you don't,

in fact you're kind of a fool. It's one of the really

great mysteries of economics that if everybody

decides it's okay, it really is okay. And if everybody decides

it's a disaster, it really is a disaster. So, everybody believing it

is a certain way makes it a certain way. From the 1950s to the 1970s, John Kenneth Galbraith was probably the most

famous economist in the world. Recurrent descent into insanity is not a wholly attractive

feature of capitalism. J.K. Galbraith

was vociferous about-- about speculative euphoria, and about why periods

of speculative euphoria just keep on happening

over periods of time. It's very much human behavior, but also our failure, uh,

to be able to deal with the worst consequences

of that euphoria. ( train chugging ) You cannot lose

with the railways They are the coming thing So come and invest

in the railways Great fortunes

for all they will bring TERRY JONES: In the 1840s, railways were promoted

as foolproof investments. Shares in them could be bought

for a 10 percent deposit. The snag was that the railway

company reserved the right to call in the remainder

at any time. Thousands of investors

on modest incomes brought large numbers

of shares while being only able

to afford the deposit. Families put their

entire savings into

prospective companies and lost everything

when the bubble burst, without knowing they took

ten times more risk

than was reasonable, and nobody prevented them

from doing so. The disreputable history

of financial euphoria goes on and on. TERRY JONES: The '20s was

an age of prosperity, but the wealth

wasn't sharedevenly throughout

the population. In 1929, the top five percent

of the population received approximately

one third of all personal income. Now the richest

five percent of humans can't eat

more than the rest of us, so they are compelled to spend

their money on luxury items such as property

or invest in stocks, thereby hoping

to increase their wealth. Not only the wealthy,

but middle class Americans were displaying what

John Kenneth Galbraith

described as... an inordinate desire

to get rich quickly with a minimum

of physical effort. TERRY JONES:

The Stock Exchange

in New York boomed. In May 1928,

the volume of shares

reached 5 million, an all-time record. The trouble was that

many investors weren't using their own money. They were borrowing

money to buy stocks. This is known in the financial

world as "buying on margin." TERRY JONES: Say you have

two hundred dollars and you borrow

eight hundred more to invest

a thousand dollars in stocks. If the price of stocks

goes up 30 percent, you make a 150 percent profit. After you repay the

eight hundred dollars, you now have five hundred

dollars for yourself. But if the price of stocks

goes down 30 percent, your stocks end up being

worth only 700 dollars, but you still need

to repay the 800 dollars. You now owe the bank

a hundred dollars. The problem is that borrowing

money to buy stocks, "buying on margin," although it amplifies

the gains, it also

amplifies the losses. You can end up owing

money to the bank without

having a penny left. TERRY JONES:

By the end of 1928, folk were swarming

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 22 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In