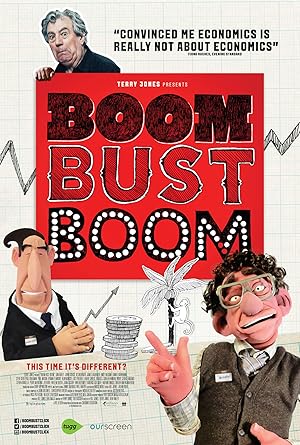

Boom Bust Boom Page #4

to buy stocks on margin. In other words, speculation

had taken a hold on people like never before. Never before or since

have so many become so wondrously, so effortlessly,

and so quickly rich. You might say

what is the difference between speculation

and gambling? Well, uh, a Journalist,

Will Payne, explains in this edition

of World's Work. A gambler only wins

because somebody

else loses. When you invest

in stocks and shares,

everybody wins. One investor buys shares

in General Motors

at a hundred dollars. He then sells it to another

for 150 dollars, who sells it to

a third for 200 dollars. Everybody makes money! TERRY JONES:

It's like conjuring, continually pulling

rabbits out of hats. And like conjuring,

it's an illusion. What Will Payne forgot

is that the stock prices

could also go down. But as long as the price

of stocks is increasing, everybody is happy

to run with it. The illusion takes hold

of formerly rational people. TERRY JONES:

Such as the Chairman of the Democratic National

Committee, John J. Raskob, who wrote an article entitled

"Everybody ought to be rich." RASKOB: Anyone who saves

15 dollars a month, invested it in sound

common stocks, and spent no dividends, would be worth some

80,000 dollars after 20 years. TERRY JONES:

Raskob wasn't aiming his

scheme at the middle classes, but at the

ordinary working man. The press was unanimous

in its praise of Raskob's

Debt Speculation Machine, a practical utopia, the greatest vision of

Wall Street's greatest mind. But not everyone was singing

from the same hymn sheet. Roger Babson, an entrepreneur

and business theorist, started to warn

about a market crash

as early as 1926. BABSON: Sooner or later

a crash is coming. Factories will shut down,

men will be thrown out of work. The result will be

a serious depression. TERRY JONES : Paul Warburg was

a banker and an early advocate of the U.S. Federal

reserve system. PAUL WARBURG:

If the present orgy

of unrestrained speculation is not brought to a halt, there will ultimately

be a general depression involving the entire country. Ah, Warburg's obsolete! Yeah, he's sandbagging

American prosperity. TERRY JONES:

Wall Street roundly

denounced Babson and Warburg. The consensus of judgment of

the millions whose evaluations on that admirable market,

the Stock Exchange, is that stocks are

not at present overvalued. The economic condition

of the world seems on the verge

of a great forward movement. Stock prices have

reached what looks like

a permanently high plateau. Where is that group of men

with the all-embracing wisdom which will entitle them

to veto the judgment of

this intelligent multitude? This advert appeared

in the Saturday Evening Post a few weeks before

the meltdown of 1929. MAN: "In 1719, there

was practically no way

of finding out the facts. "How different the position

of the investor in 1929! For now, every investor has

at his disposal, facilities

for obtaining the facts." 24 October is

the first of the days which history identifies

with the panic of 1929. That day, almost

13 million shares changed hands, many of them had prices which

shattered the dreams and hopes

of those who owned them. By 11:30, the market

had surrendered to blind,

relentless fear. Thousand of speculators

who previously had only

seen the market rising now discovered the problem

with buying on margin, as brokers sent telegrams

demanding huge amounts of cash. VINTAGE NARRATOR:

This was the case in 1929 when the overinflated

American economy, and the stock market

which fueled it, crashed. By the end of the year,

banks all over the country

were closing their doors as frightened people clamored

to reclaim their savings. To many, many watchers,

it meant that their dream-- in fact, their brief reality

of opulence-- had gone glimmering

together with home, car, furs,

jewelry and reputation. ( footsteps ) GALBRAITH: Tuesday, 29, October,

was the most devastating day in the history of the

New York Stock Market. ( paper rustling ) TERRY JONES:

The 1929 Wall Street crash was a deep

and prolonged crisis, different from some of

the previous panics in history. It combined euphoria

with massive borrowing. And speculation combined

with borrowed money is the most toxic

combination in capitalism. Yeah, yeah, I need

the crystale dropping popping I need diamonds

rocking rocking I need that money money I need that money, money I need that money, money We came out of

the Great Depression with hardly any

private sector debt. Households and firms

were not very indebted, partly because

they went bankrupt, partly because

they paid down debt and for generations Americans

were afraid to get into debt. Corporations were

afraid to get into debt. Okay, but gradually

over time because the economy

performed fairy well, gradually the memories

of the Great Depression faded and the new generations

became more willing to borrow, both households and firms, and these debt ratios

started to climb. In United States if you

look at the long sweep

of, uh, history, you'd discover that there

have been two great peaks

of private debt as a share of income. One of them occurred in 1929,

the other one occurred in 2008. The road to financial crisis--

often at least-- begins with private sector

getting careless about debt. Debts is all about debts, uh... people took on large amounts

of debt hoping that sort of wonderful things would

happen in the future that would

allow them to repay them. Nothing is ever learned

for long. We forget. People who learned that lessons,

who lived those lessons, died. And their children viewed

the Great Depression as, as a historical episode. But why does it happen

time after time throughout the centuries? TERRY JONES:

In the 1960s, '70s, and '80s,

the economist Hyman Minsky proposed the financial

instability hypothesis. -Hi, Dad.

-Oh, hello, son. -Sit down.

-Sure. -Now, listen up, Alan.

-I'm all ears, Dad. The essence of the financial

instability hypothesis is that financial traumas-- You mean crashes and such? Exactly. Occur as

a normal function in

a capitalist economy. This does not mean

the economy is always tottering on

the brink of disaster. I should hope not.

What kind of sys-- Son, be serious. The normal functioning

of an economy with a robust

financial situation is both tranquil

and on the whole successful. But tranquility

and success are not

self-sustaining states. You mean stability

leads to more optimism and therefore more borrowing

in stocks and houses. Uh-huh. And this leads

to a transformation

over time of an initially robust

financial structure into a fragile structure. Wait, let me

get this straight. After a deep depression, governments impose regulations

on the financial world. There follows

a period of stability, but the problem

with this stability is that it breathes

overconfidence. Overconfidence leads

to financial euphoria, during which time

the politicians relax

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 22 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In