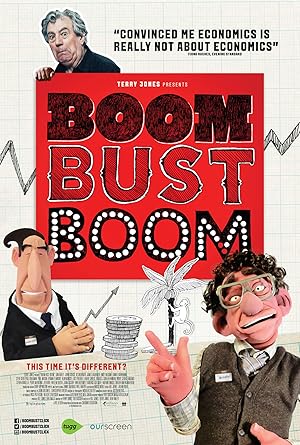

Boom Bust Boom Page #5

the regulations. This then leads

to excessive borrowing, and excessive borrowing

and euphoric bubbles

cause instability. By Jove,

I think my boy's got it. Well, I've been hearing

about it at the dinner table since I was six. Hyman Minsky

used to say, uh, stability is destabilizing. It causes people

to get overconfident, it causes people to forget about the underlying

nature of the system, that it's

inherently unstable,

inherently unstable. But it's

a powerful hypothesis. And the hypothesis

is actually, basically that, there are long cycles in which people forget about

the dangers of debt forget about

the dangers of being

a highly leveraged. That goes both for

borrowers, for lenders, for government regulators,

everybody, And the last financial

crisis recedes into the fog of memory, and that sets you up

for the next one. He predicted that financially

complex capitalism creates crashes, creates

massive booms and busts, that can on some occasions

reach the scale of 1929. So, it, 1929,

can happen again. That's "Minksy-anism." ( piano plays ) Hyman Minsky says

a bubble's in three stages. The hedge participants

are first in line. What they save

or make or get Pays the interest

on their debt The economy is

looking pretty fine The second stage involves

some speculation Speculators borrow cash

to buy more shares And as long as

nasty surprises But when it falls

It take them unawares Things have gotten

really quite unstable This is where the

dangerous stage begins People borrow more To pay their interest

as before And in the end it's just

the bank that wins But he was not himself,

uh, a banker. Okay, he was not himself,

so he had a bigger picture. He was able to

step back from this and understand

the system as a whole. For someone to write about

financial instability in the late 1950's

as he was doing, you know, this was a period

that at least on the surface was the most

financially stable period

United States had ever had, and so it didn't seem like what he was saying

was relevant, uh, to the kind of

economy we'd developed. JOHN CASSIDY: And, all the guys

in Harvard and MIT and Chicago and all

the other universities who said, look,

the financial system

is perfectly stable, what are you

talking about, Hyman? So, he was discredited,

really, inside the profession. And then suddenly, 2008,

everything goes to hell, the financial system

has basically blown up

the world, he's the man who warned that this could happen

25 years earlier, so everybody suddenly

becomes a Minskyite. Anyone who read that stuff could've seen

the crisis coming. So, the Queen asked,

you know, "Why didn't you guys

see it coming?" The answer is

they didn't read Minsky. If they had read Minsky,

they absolutely would

have seen it coming. It was really clear. You know, this is

what a boom looks like. This is in a euphoric...

system. This is what these

asset booms look like. Minsky was absolutely right. He was dead on. Which rather

begs the question, how is it we forgot about not just his work but others' work, in the period

prior to the crises. I don't just mean the three

or four years, I mean the three

or four decades when economics pursued a path that ruled out

Minsky-type dynamics for what was going wrong. Like many other people in

my economic profession, we probably didn't even

know who he was. Well, Minsky

was inconvenient. He operated always

on the margins of the... hierarchy of the

economics profession. Uh... and that made him... relatively

easy to disregard. It's a paradox, actually,

with my father, as to why he was ignored, because the very, perhaps,

reasons he was ignored, were the very reasons he

eventually became so celebrated. Hy Minsky was

a remarkably warm individual. And, I don't know

how many economists

you've ever met, okay? But that's not

particularly a trait that economists

are well known for. In university lectures, when outside professors

were brought in, Minsky would appear to be either asleep or reading the newspaper. But, as soon as

the Q-and-A time came, it was always obvious

he was the most brilliant

person in the room, who actually knew

what had been going on, and, um,

knew what was wrong with it. Minsky was a brilliant man. I only, eh... went

to a few of his lectures at Edinburgh and Cambridge, but he was very captivating. Even Minsky predicts that his warnings will

again go unheeded and he will be forgotten. So it seems like now is the time

when he's being remembered, and, hopefully maybe

he's wrong, we won't forget

what he is saying. One of the ironies about

the 2008 crisis is that, um, Minsky's books

were out of print. His last book,

Stabilizing An

Unstable Economy, as the crash was happening, and as asset prices

were falling, uh, the price of

his book was being bid

up and up and up, because everyone

wanted to read his book

about the, uh, about the crises

that was happening. Stability leads

to instability. Euphoria makes us blind. And we take

irresponsible risks that eventually

lead to disaster. So stable

and booming markets make us blind to

the increasing risks. But can we measure

this blindness? Well, yes. There is an index

based on the price people are willing to pay for protection

against the market crash. This is the market traded

price of risk. And what is interesting is that this price of risk actually declines to very low levels during periods

when stock markets go sky high

and instability grows. So our perception

of risk runs contrary

to the actual risk. In the crash of 2008, the price of risk was at

its lowest level ever. You're not allowed

to teach that in universities. You can, but you won't

get a chair of economics at a major, prestigious,

global university. Only the economics

that says capitalism's stable can be thought

at these universities. The conventional

economic model which is used

to run the economy is known as the free market, or neoclassical

economic theory, and it is based on the idea that we are all rational

when it comes to money, that the economy

will always find itself

in an equilibrium, and the bubbles

simply can't happen. Neoclassical economics

is this wonderful thing. It's useful, actually. I use it myself

all the time. It says, let's posit a world

of perfectly rational people operating in perfectly

competitive markets and see how they interact, and see what kind of,

you know, properties. And, it turns out that

if the world really

was like that, there would be all kinds

of nice things. So economists, uh, think about the world using, uh, models. And what does that mean? Okay, that's

a simplified version

of the world, um, taking out one or two or

maybe three essential features of the world and acting as if those are

the only features of the world, and, and building-- building out the

consequences of those

three kind of features. Models are just stories. You know, they say,

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 23 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In