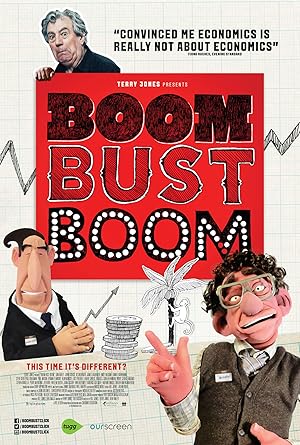

Boom Bust Boom Page #6

if you do this, then that will happen.

That's all they are. If you choose the three

most essential features, then you have a good model. If you choose three features that are not very essential, then you have a model that's not really gonna

help you with your problem. It's a useful-- it's

an intuition pump, right? It helps you think about

why markets sometimes

work really well, helps you think

about something. But if you start

to believe that

it is not a... helpful, ah, fairytale, but actually the truth,

then you're in big trouble, because the world

doesn't work like that, and at times like this,

depression times, it really doesn't

work like that. So neoclassical economics

is a potential trap. So if I put it

really at its simplest, you build a model

where you say, we assume depressions

are not possible. That unfortunately,

is not the world we live in. Conventional economists

don't like to model debt into their economic models because debt makes

the models unstable, so they omit it altogether. It's modeling

what is easier to model rather than what is

happening in the real world. They-they will not break

away from this 19th century, uh, heuristics

that they thought would make it easier

to solve the problem. In fact, they've made

it far harder, and it's why they had no idea

this crises was coming because they ignored

banks, debt, and money. It was a serious, serious

professional problem. We had a situation-- to compare it to doctors

for a second, real doctors. We had a situation where

the patient was bleeding, but we didn't really recognize

the presence of blood. Like, it's that serious,

you know. Why doesn't it appear

ridiculous to economists to use models

without money? Uh, I'm

an economist myself, and it does appear

ridiculous to me. So, there's at least

one exemption to that, and quite a few others

to be sure. It is very hard

to, uh, understand the reasons why economists

focused on models, eh, in which crises, eh, could not occur, were impossible. I think economics

has this lure that the moment we can

explain something in a beautiful model,

it's just elegant. And you want the world

to be elegant. One dream One soul One prize One goal One goal One golden glance Of what should be It's a kind of magic One shaft Of light That shows the way No mortal man Can win this day It's a kind of magic The bell that rings Inside your mind Is challenging The doors of time The waiting seems Eternity The day will dawn Of sanity is this a kind of magic? I think deregulation

has about it a sort of natural bubble, which is that

when you allow people a massive amount of freedom, they enjoy it. Key parts of

the regulatory apparatus were being run by people who didn't believe

in their job. They-- they believed

that their job was to get out of the way of the banks, or to-- or even

to help the banks, but not to--

not to protect us from-- uh, from banks gone bad. We had a banking system with regulators

who encouraged risk-taking. They positively encouraged

and rewarded risk-taking, and politicians

stood up and said that not just risk-taking

is all right, guys, they said

the risk-taking is good. The riskier the better. We are sure that everything Is hunky-dory,

that's our story Everything will

work out fine Like good wine,

it just needs time Market freedom is the thing To cure all ills

and that's why we sing Keep the markets

free, free, free For all eternity,

that's the only way to be We have a free market

ideology that says the more you remove the state from the market, the more the market is

allowed to do what it does, which is to-- to bring millions of decisions by people, every day,

together, in a way that provides

a rational outcome. So, the market is

our collective rationality. I suppose

the free market ideology is where you have

a fundamental belief that markets are

the optimum way to create wealth and to distribute

goods and services

throughout society. CASSIDY: Alan Greenspan

sort of exemplified the rise or the comeback

of free market economics after it had been discredited

in the 1930s. You can really trace the whole rise of it

through his career, actually. He was a man who had,

for decades, applied a certain way

of thinking. And... and he was-- And he made

very significant decisions that influenced

the economy of the world based on that framework. Alan Greenspan, I think,

had deep, deep belief in lack of regulation. Right? And, so, he basically, eliminated many

of the regulations, allowing all the economic agents to act as they wished. And that framework

assumed that-- that the agents in the economy

are rational... including banks. There is a book called Maestro

written about him, describing him as a genius for not having listened

to naysayers who said, "You should

slow this expansion down." KRUGMAN: The crash was,

in fact, the proof that the Greenspan view

that markets were self-policing, self-regulating

was all wrong. CASSIDY: So, he was hauled

before Congress to, you know, say, well, you know,

"You've been telling us

all for years we don't need

financial regulation, we don't need to

worry about the market. What went wrong?

Did anything go wrong?" And he said, "Partially.

Something partially went wrong." And they said, "What would you

mean by that Mr. Greenspan? You know, uh,

what partially went wrong?" You found a flaw in...

reality-- GREENSPAN: The one flaw

in the model that I perceived as the critical

functioning structure that defines how the world

works, so to speak. In other words,

you found that your-- your view of the world,

your ideology was not right. -It was not working.

-GREENSPAN:

That it. How do I-- Precisely. You know, I-- That's preciselythe reason I was shocked because I've been going

for 40 years or more with very considerable evidence that it was

working exceptionally well. Quite amazing when he said that

my view of the world was wrong. it was a startling admission, an indication that... perhaps there was some-- some humility

and hope for redemption um, in Mr. Greenspan, which turns out

to have been untrue. Uh, almost immediately,

he went right back to pronouncing with great certainty and impeccable wrongness

about everything. CUSACK: We really, sort of,

made people like Greenspan these, kind of, holy bishops, and every word that

they said was reinforced. I mean, they were popes

or something, or cardinals. And, so, I think for this guy to come-- come on

and have to admit that basically everything

that he believed was wrong, um, just shows you that

this is a-- this is a joke. You're all individuals! ALL: Yes!

We're all individuals! You're all different! Yes! We're all different. -MAN: I'm not.

-ALL:

Shh! Shh! If you try and read economiespurely rationally, I think that's

a real mistake because economies operate

with a herd mentality, sure. But it's a herd made up

of human beings who are very you know, complicated,

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Boom Bust Boom" Scripts.com. STANDS4 LLC, 2025. Web. 23 Feb. 2025. <https://www.scripts.com/script/boom_bust_boom_4489>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In