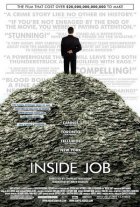

Inside Job

01:

00:00.00{START}

{TITLE:

SONY PICTURES CLASSICS}{The global economic crisis of 2008

cost tens of millions of people their

savings, their jobs, and their homes.

This is how it happened.}

01:

00:41.18{ICELAND

POPULATION:

320,000GROSS DOMESTIC PRODUCT: $13 BILLION

BANK LOSSES:

$100 BILLION}01:

01:07.00NARRATOR:

Iceland is a stable democracy with a high standard of living; and untilrecently, extremely low unemployment and government debt.

ANDRI MAGNASON:

We had the complete infrastructure of a modern society; cleanenergy, food production, fisheries, with a quota system to manage them.

GYLFI ZOEGA:

Good healthcare, good education; you know, clean air; uh, not muchcrime; uh, it's good, a good place for families to live.

ANDRI MAGNASON:

We had almost, uh, end-of-history status.01:

01:40.15NARRATOR:

But in 2000, Iceland's government began a broad policy of deregulationthat would have disastrous consequences; first for the environment, and then for the

economy. They started by allowing multinational corporations like Alcoa to build giant

aluminum-smelting plants, and exploit Iceland's natural geothermal and hydroelectric

energy sources.

ANDRI MAGNASON:

Many of the most beautiful areas in the highlands, with the mostspectacular colors, are geothermal. So nothing comes without consequence.

01:

02:38.19[BOOM!]

01:

02:53.15Inside Job transcript – Sony Pictures – September 2010

2

NARRATOR:

At the same time, the government privatized Iceland's three largest banks.The result was one of the purest experiments in financial deregulation ever conducted.

01:

03:09.20{SEPTEMBER 2008}

DEMONSTRATOR:

We have had enough! But how could all of this happen?GYLFI ZOEGA:

Finance took over. Um, and uh, more or less wrecked the place.NARRATOR:

In a five-year period, these three tiny banks, which had never operatedoutside of Iceland, borrowed 120 billion dollars, ten times the size of Iceland's economy.

The bankers showered money on themselves, each other, and their friends.

01:

03:35.27GYLFI ZOEGA:

There was a massive bubble. Stock prices went up by a factor of nine;uh, house prices more than doubled.

NARRATOR:

Iceland's bubble gave rise to people like Jón Ásgeir Jóhannesson. Heborrowed billions from the banks to buy up high-end retail businesses in London. He

also bought a pinstriped private jet, a 40-million-dollar yacht, and a Manhattan

penthouse.

01:

04:01.17ANDRI MAGNASON:

Newspapers always had the headline: this millionaire bought thiscompany, uh, in the UK, or in Finland, or in, in France, or wherever; uh, instead of

saying, this millionaire took a billion-dollar loan to buy this company, and he took it from

your local bank.

01:

04:22.15GYLFI ZOEGA:

The banks set up money market funds. And the banks advised deposit-holders to withdraw money, and put them in the money market funds. The Ponzi

scheme needed everything it could, huh?

01:

04:33.05NARRATOR:

American accounting firms, like KPMG, audited the Icelandic banks andinvestment firms, and found nothing wrong; and American credit-rating agencies said

Iceland was wonderful.

SIGRÍ.UR BENEDIKTSDÓTTIR: In February 2007, the rating agencies decided to

upgrade the banks to the highest possible rate – AAA.

Inside Job transcript – Sony Pictures – September 2010

3

GYLFI ZOEGA:

It went so far as the government here traveling with the bankers, as a,as, as a PR show.

01:

05:03.15NARRATOR:

When Iceland's banks collapsed at the end of 2008, unemployment tripledin six months.

ANDRI MAGNASON:

There is nobody unaffected in Iceland.01:

05:22.24CHARLES FERGUSON: So a lot of people here lost their savings.

GYLFI ZOEGA:

Yes, that's the case.NARRATOR:

The government regulators who should have been protecting the citizensof Iceland had done nothing.

GYLFI ZOEGA:

You have two lawyers from the regulator, {STUTTER} going to a bankto talk about some issue. When they approach the bank, they would see 19, uh, SUVs

outside, heh, outside the bank. Right? So you got to the bank, and you have the 19

lawyers sitting, uh, in front of you, right? They are very well prepared; uh, uh, ready to

kill any argument you make. And then, if you do really well, they offer you a job, right?

01:

06:01.24NARRATOR:

One-third of Iceland's financial regulators went to work for the banks.GYLFI ZOEGA:

But this is a universal problem, huh. In New York, you have the sameproblem, right?

01:

06:13.25 {MUSIC CUE}{SONY PICTURES CLASSICS

PRESENTS:

A REPRESENTATIONAL PICTURES FILM

IN ASSOCIATION WITH

SCREEN PASS PICTURES

A CHARLES FERGUSON FILM}

{INSIDE JOB}

Inside Job transcript – Sony Pictures – September 2010

01:

06:44.22CHARLES FERGUSON: What do you think of Wall Street incomes these days?

PAUL VOLCKER:

Excessive.{PAUL VOLCKER

FORMER FEDERAL RESERVE CHAIRMAN}

01:

06:51.17CHARLES FERGUSON: I have been told it's extremely difficult for the IMF to criticize

the United States.

DOMINIQUE STRAUSS-KAHN: I won't say that.

{DOMINIQUE STRAUSS-KAHN

MANAGING DIRECTOR

INTERNATIONAL MONETARY FUND}

MARK BRANSON:

We deeply regret our breaches of U.S. law.{NARRATED BY MATT DAMON}

01:

07:12.18JONATHAN ALPERT:

They’re amazed at how much cocaine these Wall Streeters canuse, and get up and go to work the next day.

01:

07:21.21GEORGE SOROS:

I didn't know what credit default swaps are. I'm a little bit old-fashioned.

{GEORGE SOROS

BILLIONAIRE INVESTOR, PHILANTHROPIST}

{MUSIC SUPERVISOR: SUSAN JACOBS}

CHARLES FERGUSON: Has Larry Summers ever expressed remorse?

REP. BARNEY FRANK: Um, I, I don't hear confessions.

Inside Job transcript – Sony Pictures – September 2010

{BARNEY FRANK

CHAIRMAN, FINANCIAL SERVICES COMMITTEE

U.S. HOUSE OF REPRESENTATIVES}

{DIRECTORS OF PHOTOGRAPHY

SVETLANA CVETKO &

KALYANEE MAM}

{RESEARCH:

KALYANEE MAM}01:

07:52.07KENNETH ROGOFF:

The government's just writing checks. That's Plan A, that's PlanB, and that's Plan C.

CHARLES FERGUSON: Would you support legal controls on executive pay?

DAVID McCORMICK:

Uh, I, I would not.{DAVID McCORMICK

UNDER SECRETARY OF THE TREASURY

BUSH ADMINISTRATION}

01:

08:07.00CHARLES FERGUSON: Are you comfortable with the level of compensation in the

financial services industry?

SCOTT TALBOTT:

If they’ve earned it, then yes. I am.CHARLES FERGUSON: Do you think they've earned it?

SCOTT TALBOTT:

I think they've earned it.{SCOTT TALBOTT

CHIEF LOBBYIST:

FINANCIAL SERVICES ROUNDTABLE}

01:

08:17.00CHARLES FERGUSON: And so you've helped these people blow the world up.

SATYAJIT DAS:

Oh, you could say that.{GRAPHICS BY BIGSTAR}

01:

08:31.00Inside Job transcript – Sony Pictures – September 2010

ANDREW SHENG:

They were having massive private gains at public loss.{ANDREW SHENG

CHIEF ADVISOR:

CHINA BANKING REGULATORY COMMISSION}

{EDITORS

01:

08:43.20LEE HSIEN LOONG:

When you start thinking that you can create something out ofnothing, it's very difficult to resist.

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Inside Job" Scripts.com. STANDS4 LLC, 2025. Web. 21 Feb. 2025. <https://www.scripts.com/script/inside_job_42>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In