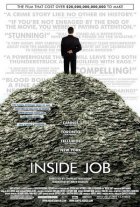

Inside Job Page #2

{LEE HSIEN LOONG

PRIME MINISTER, SINGAPORE}

01:

09:03.04CHRISTINE LAGARDE: I'm concerned that a lot of people want to go back to the old

way; the way they were operating prior to the crisis.

{CHRISTINE LAGARDE

FINANCE MINISTER, FRANCE}

{ASSOCIATE PRODUCERS

KALYANEE MAM:

& ANNA MOOT-LEVIN}

01:

09:20.00{GILLIAN TETT

U.S. MANAGING EDITOR

THE FINANCIAL TIMES}

GILLIAN TETT:

I was getting a lot of anonymous e-mails from bankers; saying, youcan't quote me, but I'm really concerned.

01:

09:32.00CHARLES FERGUSON: Why do you think there isn't a more systematic investigation

being undertaken?

Inside Job transcript – Sony Pictures – September 2010

7

{EXECUTIVE DIRECTORS

JEFFREY LURIE &

CHRISTINA WEISS LURIE}

NOURIEL ROUBINI:

Because then you will find the culprits.{NOURIEL ROUBINI

PROFESSOR, NYU BUSINESS SCHOOL}

01:

09:42.00CHARLES FERGUSON: Do you think that Columbia Business School has any

significant conflict-of-interest problem?

GLENN HUBBARD:

I don't see that we do.{GLENN HUBBARD

CHIEF ECONOMIC ADVISOR, BUSH ADMINISTRATION

DEAN, COLUMBIA BUSINESS SCHOOL}

01:

09:58.00{ELLIOT SPITZER

FORMER NEW YORK ATTORNEY GENERAL}

ELIOT SPITZER:

The regulators didn't do their job. They, they had the power todo every case that I made when I was state attorney general. They just didn't want to.

{PRODUCED, WRITTEN AND DIRECTED BY

CHARLES FERGUSON}

01:

10:22.00{SEPTEMBER 15, 2008}

NEWS REPORTER:

Over the weekend, Lehman Brothers, one of the most venerableand biggest investment banks, was forced to declare itself bankrupt; another, Merrill

Lynch, was forced to sell itself today. Crisis talks are underway –

Inside Job transcript – Sony Pictures – September 2010

8

WOMAN REPORTER:

World financial markets are way down today, following dramaticdevelopments for two Wall Street giants.

WOMAN SPEAKING FOREIGN LANGUAGE: [UI].

MAN SPEAKING FRENCH: [UI].

01:

10:45.00NARRATOR:

In September 2008, the bankruptcy of the U.S. investment bank LehmanBrothers, and the collapse of the world's largest insurance company, AIG, triggered a

global financial crisis.

NEWSCASTER:

– fears gripped markets overnight, with Asian stocks slammed by –NEWSMAN:

Stocks fell off a cliff – the largest single point drop in history.NEWSMAN WITH BRITISH ACCENT: Share prices continued to tumble in the

aftermath of the Lehman collapse.

01:

11:10.00NARRATOR:

The result was a global recession, which cost the world tens of trillions ofdollars; rendered 30 million people unemployed; and doubled the national debt of the

United States.

01:

11:21.00{NOURIEL ROUBINI

SENIOR ECONOMIST

COUNCIL OF ECONOMIC ADVISORS (1998-2000)

PROFESSOR, NYU BUSINESS SCHOOL}

NOURIEL ROUBINI:

If you look at the cost of it — destruction of equity wealth, ofhousing wealth; the destruction of income, of jobs; 50 million people globally could end

up below the poverty line again — this is just a, a hugely, hugely expensive crisis.

01:

11:41.00NARRATOR:

This crisis was not an accident. It was caused by an out-of-controlindustry. Since the 1980s, the rise of the U.S. financial sector has led to a series of

increasingly severe financial crises. Each crisis has caused more damage, while the

industry has made more and more money.

Inside Job transcript – Sony Pictures – September 2010

9

01:

12:03.25 {PART I: HOW WE GOT HERE}NARRATOR:

After the Great Depression, the United States had 40 years of economicgrowth, without a single financial crisis. The financial industry was tightly regulated.

Most regular banks were local businesses, and they were prohibited from speculating

with depositors' savings. Investment banks, which handled stock and bond trading, were

small, private partnerships.

01:

12:33.00{SAMUEL HAYES

Inside Job transcript – Sony Pictures – September 2010

PROFESSOR EMERITUS OF INVESTMENT BANKING

Inside Job transcript – Sony Pictures – September 2010

11

HARVARD BUSINESS SCHOOL}

SAMUEL HAYES:

In the traditional, uh, investment-banking-partnership model, thepartners put the money up. And obviously, the partners watched that money very

carefully. They wanted to live well, but they didn't want to bet the ranch on anything.

01:

12:48.02NARRATOR:

Paul Volcker served in the Treasury Department, and was chairman of theFederal Reserve from 1979 to 1987. Before going into government, he was a financial

economist at Chase Manhattan Bank.

{PAUL VOLCKER

Inside Job transcript – Sony Pictures – September 2010

CHAIRMAN:

Inside Job transcript – Sony Pictures – September 2010

13

FEDERAL RESERVE BOARD (1979-1987)}

PAUL VOLCKER:

When I left Chase to go in the Treasury, in 1969, I think my incomewas in the neighborhood of 45,000 dollars a year.

CHARLES FERGUSON: Forty-five thousand dollars a year.

01:

13:11.00SAMUEL HAYES:

Morgan Stanley, in 1972, had approximately 110 total personnel; oneoffice; and capital of 12 million dollars.

Now, Morgan Stanley has 50,000 workers, and has capital of several billion; and has

offices all over the world.

01:

13:36.14NARRATOR:

In the 1980s, the financial industry exploded. The investment banks wentpublic, giving them huge amounts of stockholder money. People on Wall Street started

getting rich.

01:

13:49.00{CHARLES MORRIS

AUTHOR:

THE TWO TRILLION DOLLAR MELTDOWN}

CHARLES MORRIS:

I had a friend who was a bond trader at Merrill Lynch in the 1970s.He had a job as a train conductor at night, 'cause he had three kids and couldn't support

them on what a bond trader made. By, heh, 1986, he was making millions of dollars,

and thought it was because he was smart.

01:

14:13.14RONALD REAGAN:

The highest order of business before the nation is to restore oureconomic prosperity.

NARRATOR:

In 1981, President Ronald Reagan chose as Treasury secretary the CEOof the investment bank Merrill Lynch, Donald Regan.

01:

14:27.00{DONALD REGAN

TREASURY SECRETARY (1981-1985)}

DONALD REGAN:

Wall Street and the president do see eye to eye.Inside Job transcript – Sony Pictures – September 2010

14

I've talked to many leaders of Wall Street. They all say, we're behind the president one

hundred percent.

NARRATOR:

The Reagan administration, supported by economists and financiallobbyists, started a 30-year period of financial deregulation.

01:

14:45.00 In 1982, the Reagan administration deregulated savings and loancompanies, allowing them to make risky investments with their depositors' money. By

the end of the decade, hundreds of savings and loan companies had failed. This crisis

cost taxpayers 124 billion dollars, and cost many people their life savings.

TOM BROKAW:

It may be the biggest bank heist in our history.NARRATOR:

Thousands of savings and loan executives went to jail for looting theircompanies. One of the most extreme cases was Charles Keating.

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Inside Job" Scripts.com. STANDS4 LLC, 2025. Web. 22 Feb. 2025. <https://www.scripts.com/script/inside_job_42>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In