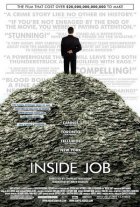

Inside Job Page #4

FRANKLIN RAINES:

These accounting standards are highly complex, and requiredeterminations over which experts often disagree.

NARRATOR:

CEO Franklin Raines, who used to be President Clinton's budget director,received over 52 million dollars in bonuses.

01:

21:43.18{UBS FRAUD – FINED $780 MILLION}

When UBS was caught helping wealthy Americans evade taxes, they refused to

cooperate with the U.S. government.

SEN. CARL LEVIN:

Would you be willing to supply the names?MARK BRANSON:

If there's a treaty framework –SEN. CARL LEVIN:

No treaty framework; you've agreed you participated in a fraud.MARK BRANSON:

Mm.01:

22:09.14{HELPED ENRON CONCEAL FRAUD: FINED $385 MILLION

CITIBANK – JP MORGAN – MERRILL LYNCH}

Inside Job transcript – Sony Pictures – September 2010

19

NEWSCASTER:

But while the companies face unprecedented fines, the investmentfirms do not have to admit any wrongdoing.

01:

22:16.02SCOTT TALBOTT:

When you're this large, and you're dealing with this many productsand this many customers, mistakes happen.

CHARLES FERGUSON: The financial services industry seems to have a level of

criminality that is, you know, somewhat distinctive. When was the last time that Cisco or

Intel or Google or Apple or IBM, you know –

ELIOT SPITZER:

I totally agree with you about high tech versus financial services. Buthigh tech –

CHARLES FERGUSON: So how come? What, what's –

ELIOT SPITZER:

Well, high tech is a fundamentally creative business, where the valuegeneration and the income derives from actually creating something new and different.

01:

22:48.17NARRATOR:

Beginning in the 1990s, deregulation and advances in technology led toan explosion of complex financial products, called derivatives. Economists and bankers

claimed they made markets safer. But instead, they made them unstable.

01:

23:04.20ANDREW SHENG:

Since the, uh, end of the Cold War, uh, a lot of, uh, phys-, formerphysicists and mathematicians decided to u-, apply their skills not on, you know, Cold

War technology, but on financial markets. And uh, together with investment bankers and

hedge funds –

CHARLES FERGUSON: Creating different weapons.

ANDREW SHENG:

Absolutely! You know, as Warren Buffett said; you know, weaponsof mass destruction.

01:

23:25.23{ANDREW LO

PROFESSOR & DIRECTOR

MIT LABORATORY FOR FINANCIAL ENGINEERING}

ANDREW LO:

Regulators, politicians, and businesspeople did not take seriously thethreat of financial innovation on the, uh, the stability of the financial system.

Inside Job transcript – Sony Pictures – September 2010

20

01:

23:36.23NARRATOR:

Using derivatives, bankers could gamble on virtually anything. They couldbet on the rise or fall of oil prices, the bankruptcy of a company; even the weather. By

the late 1990s, derivatives were a 50-trillion-dollar unregulated market.

01:

23:54.20 In 1998, someone tried to regulate them.Brooksley Born graduated first in her class at Stanford Law School, and was the first

woman to edit a major law review. After running the derivatives practice at Arnold &

Porter, Born was appointed by President Clinton to chair the Commodity Futures Trading

Commission, which oversaw the derivatives market.

01:

24:17.24MICHAEL GREENBERGER: Brooksley Born asked me if I would come work with her.

Uh, we decided that this was a serious, potentially destabilizing market.

{MICHAEL GREENBERGER

FORMER DEPUTY DIRECTOR (1997-2000)

COMMODITY FUTURES TRADING COMMISSION}

NARRATOR:

In May of 1998, the CFTC issued a proposal to regulate derivatives.Clinton's Treasury Department had an immediate response.

01:

24:38.08MICHAEL GREENBERGER: I happened to go into Brooksley's office. And she was just

putting down the receiver on her telephone. And the blood had drained from her face.

And she looked at me, and said: That was Larry Summers. He had 13 bankers in his

office. He conveyed it in a very bullying fashion – sort of directing her to stop.

01:

25:06.03{SATYAJIT DAS

DERIVATIVES CONSULTANT

AUTHOR, TRADERS, GUNS & MONEY}

SATYAJIT DAS:

The banks were now heavily reliant for earnings on these types ofactivities. And that led to a titanic battle to prevent this set of instruments from being

regulated.

NARRATOR:

Shortly after the phone call from Summers, Greenspan, Rubin, and SECChairman Arthur Levitt issued a joint statement condemning Born, and recommending

legislation to keep derivatives unregulated.

Inside Job transcript – Sony Pictures – September 2010

{JULY 24, 1998}

ALAN GREENSPAN:

Regulation of derivatives transactions that are privatelynegotiated, by professionals, is unnecessary.

01:

25:38.29REP. BARNEY FRANK: She was overruled, unfortunately, uh, first by the Clinton

administration; and then by the Congress. In 2000, uh, Senator Phil Gramm took a

major role in getting a bill passed that pretty much exempted derivatives from, from

regulation.

{JULY 21, 2000

CHAIRMAN:

SENATE BANKING COMMITTEE}

PHIL GRAMM:

They are unifying markets, they are reducing regulatory burden. Ibelieve that we need to do it.

PHIL GRAMM BECAME VICE-CHAIRMAN OF UBS.

SINCE 1993, HIS WIFE WENDY HAD

SERVED ON THE BOARD OF ENRON.}

01:

26:06.17{LARRY SUMMERS

TREASURY SECRETARY (1999-2001)}

LARRY SUMMERS:

Our very great, uh, hope; that it will be possible to move this yearon legislation that in a suitable way goes to create legal certainty for OTC, uh,

derivatives.

$20 MILLION AS A CONSULTANT TO A HEDGE

FUND THAT RELIED HEAVILY ON DERIVATIVES.}

ALAN GREENSPAN:

I wish to associate myself with all of the remarks of SecretarySummers.

{ALAN GREENSPAN

CHAIRMAN, FEDERAL RESERVE BOARD}

01:

26:34.24Inside Job transcript – Sony Pictures – September 2010

NARRATOR:

In December of 2000, Congress passed the Commodity FuturesModernization Act. Written with the help of financial-industry lobbyists, it banned the

regulation of derivatives.

01:

26:48.12{FRANK PARTNOY

PROFESSOR LAW AND FINANCE

UNIVERSITY OF CALIFORNIA, SAN DIEGO}

FRANK PARTNOY:

Once that was done, it was off to the races. And the use ofderivatives and financial innovation, uh, exploded dramatically after 2000.

01:

26:58.02 {JANUARY 20, 2001}MAN:

– so help me God.GEORGE W. BUSH:

– so help me God.NARRATOR:

By the time George W. Bush took office in 2001, the U.S. financial sectorwas vastly more profitable, concentrated, and powerful than ever before. Dominating

this industry were five investment banks;

{GOLDMAN SACHS

MORGAN STANLEY:

LEHMAN BROTHERS:

MERRILL LYNCH:

BEAR STEARNS}

– two financial conglomerates;

{CITIGROUP

JP MORGAN}

– three securities-insurance companies;

{AIG

MBIA:

AMBAC}

– and three rating agencies.

{MOODY'S

STANDARD & POOR'S

FITCH}

Inside Job transcript – Sony Pictures – September 2010

23

And linking them all together was the securitization food chain, a new system which

connected trillions of dollars in mortgages and other loans with investors all over the

world.

Translation

Translate and read this script in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Citation

Use the citation below to add this screenplay to your bibliography:

Style:MLAChicagoAPA

"Inside Job" Scripts.com. STANDS4 LLC, 2025. Web. 22 Feb. 2025. <https://www.scripts.com/script/inside_job_42>.

Discuss this script with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In